Financial states of UFC and Bellator: Looking back at 2018, forward to 2019

Every year, there seemingly will always be points in the year where those in the community who are baselessly making their claims for whatever reason that MMA, or more specifically the UFC, is not flourishing in the business department.

However, that continues to prove untrue when really looking deeper at the numbers. Even though without looking deeper we can still see the big deals that are being made…

To help take a look at things, BJPenn.com’s Drake Riggs caught up with an avid follower of combat sports’ business side who specializes in MMA and pro wrestling, FrankieNYC.

In 2018, the UFC didn’t happen to be the only big name MMA organization that found some good success. Their biggest competitor in North America, Bellator MMA, also had a big year by signing a deal with the streaming service known as DAZN.

“I believe they might be the biggest news of 2019 as far as MMA financials go,” FrankieNYC said. “With DAZN bringing $33M per year to Bellator ($100M, three year guarantee with a two year option) according to Dave Meltzer, this should be their first year making a profit. That is extremely huge for MMA if it comes to fruition. MMA needs a financially sound alternative to UFC. It should also guarantee they do over $50M in revenue for the first time in history.”

On the flipside of things, the UFC also happened to strike quite the new deal when it comes to where their content will be able to be viewed for the coming years.

With their Fox deal over, it’s now onto ESPN for the worldwide leader in MMA. The deal is in place for the next five years.

“With the $300M guarantee from ESPN for content on both ESPN and ESPN+, that should add $100M to their revenue with most going to profit,” FrankieNYC said. “TV deals escalate per year as far as payments go. So UFC’s last year with Fox was somewhere in the $160M, area. So while ESPN is averaging $300M per year, the first year might be $260M-275M per.

“That alone is a major financial addition to a company that is a $700M-800M per year revenue company with a rumored $300M per year approximate profit (last two years).

“But when adding the ESPN money, we must consider that due to ESPN+ taking a lot of live content away from UFC’s own Fight Pass that UFC should lose money in subscriber cancellations. If they lose 100K in subs, that can be $8M-9M in losses yearly. Not a huge difference to the bottom line, but something very few discuss. With the new US TV deal, new pay-per-view deal plus other escalating deals, UFC could certainly have another record-breaking year of profit.”

In addition to the TV deal for the UFC, their pay-per-view revenue is reportedly also set to greatly increase. Thanks to the potential new revenue split, it would make it rather unlikely that the pay-per-view product will be going anywhere any time soon.

With the revenue split in place, distribution to the provider goes from 50 percent to about 30 percent. Meaning that, for example, the revenue would be evenly distributed by $50M in pay-per-view as $25M is for the UFC and $25M is for the pay-per-view providers. The new distribution would be $35M for the UFC and $15M for the providers (excluding UFC.TV purchases).

Nothing is concrete on that however as negotiations have been reportedly ongoing and the UFC has since confirmed.

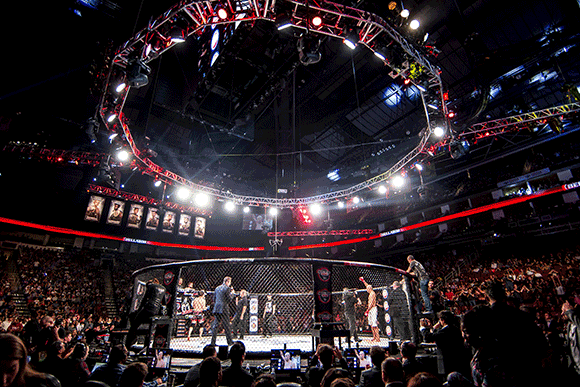

PhotoCred: Mohegan Sun Arena

For Bellator, rumors recently surfaced that Viacom actually could be looking to sell them. While that is currently nothing more than just a rumor, numbers were a bit concerning when it comes to shows they aired under that umbrella.

“I wouldn’t doubt it could be true. Bellator lost a lot of viewers, 25 to 35 percent, airing on Viacom owned stations in the US.” FrankieNYC shared. “Part of the last three and a half months drop could be attributed to DAZN airing as well, but according to early reports, the DAZN numbers are still in the early growth stage. Bellator has not been a profit as a single entity for Viacom. Viacom could make up losses with high ad-revenue, but with ratings heading south, I could see them looking to sell.”

While Bellator has rumblings of getting sold, the opposite is the case for the WME-IMG owned UFC.

UFC President Dana White came out in August and stated that the UFC, which was sold to WME-IMG for $4B, is now worth $7B.

This was said in August. At the time, that may have been a little bit exaggerated. But it’s much more believable to say at a later time in 2019. Especially considering the previously mentioned revenue split for pay-per-view.

“From what we know, [White] came to that [number] due to WME/Endeavor buying the shares at that evaluation that Flash Entertainment owned.” FrankieNYC said. “Now with the new ESPN deal and escalating worldwide contracts, could UFC be worth $7B in 2019? If they have a record-breaking year, they could be. But I find it very hard to believe it was worth that in August-September of 2018.

“The [UFC] pay-per-view deals with DTV and InDemand ended 2018. So either they agreed to a new pay-per-view deal or negotiations went badly and the canceled January pay-per-view [UFC 233] could have been a byproduct of that. But the reality is, the UFC is in a great position to negotiate the rumored 70/30 split with providers going forward. What could that mean to UFC’s bottom line? It could be about an additional $10 per buy for traditional pay-per-view. If UFC does 4M-5M traditional (non-digital buys) in 2019, that is about $40M-$50M additional revenue that should be all profit.

“How big is that?” FrankieNYC continued. “The ESPN deal and the new pay-per-view deal alone might beat the Fertitta era’s best profit year of $152M in 2015. 2016 was better but that was a year where the sale occurred mid-year.”

PhotoCred: Sherdog

With Viacom not profiting off of Bellator while Bellator splits their airtime on Viacom stations and now DAZN, it could seem like why not let them go, right?

Sure, but the DAZN deal is still in its infancy as Bellator 206 in September 2018 marked the first event to be streamed on the service.

“The DAZN low numbers are to be expected at this early stage.” FrankieNYC reaffirmed.

“At this point, I don’t think anybody could expect the DAZN numbers to be in the millions.

“Regarding a good time for Viacom to sell… Well, they have three years of DAZN money that should lead them to profit each year. So, from that standpoint alone it is a good time to sell. Plus, don’t forget that Viacom met with WME/Endeavor back in May to discuss the UFC TV rights stateside, according to John Ourand at Sports Business Daily. Think about that for a minute and it makes you wonder about Viacom being in the Bellator business long term.”

When it comes to the end of 2018, Bellator’s final show was their big touch down in Hawaii with Bellator 213 in early December. For the UFC, UFC 232 closed out the year on the 29th.

Although, the event was seemingly in danger of being canceled thanks to the controversy roller coaster that can often come alongside UFC light heavyweight champion Jon Jones.

When the event’s headliner was in jeopardy, instead of canceling the fight itself or moving the event to another date, the UFC instead relocated the entire event on just a one week notice.

“Speculation is that WME/Endeavor might have had a management bonus they were within reach of.” FrankieNYC responded when speaking on why the UFC had to keep the event within the 2018 calendar. “A lot of people don’t realize, but WME/Endeavor are not full owners of UFC. They get a reported $25M per year to manage UFC before profits are divided. So, it is certainly possible there was a year-end bonus tied into the decision to move UFC 232 instead of going with [Cris] Cyborg vs [Amanda] Nunes as the main event. Now the obvious [question] is how much money could they make with the move.

“Well, for every 100K in pay-per-view buys that Jones – Gustafsson might bring, UFC would bring in about $3.5-4.0M in revenue. Of course, you need to subtract the cost of the refunds and added expense and it seems they will need 150K or so to break even.

Cyborg has done 380K with Holly [Holm] as a pay-per-view headliner, so a low estimate with Nunes could [have been] 300K. Any 500K or under makes you wonder why they would move it, but if it does 750K or above, it made sense.”

In regards to if indeed UFC 232 did go over 750K buys, the rumor is that that is trending to be the case. Thus making it the second biggest event of the year behind UFC 229 which broke the all-time pay-per-view buy record with 2.4M.

All in all, things aren’t looking too bad for MMA’s top dogs.

(Feel free to message FrankieNYC directly at FrankieNYC.TheBiz[at]gmail.com with any questions you may have. FrankieNYC would also like to acknowledge Dave Meltzer, John Nash, and John Ourand as the source for much of his info)

on 1/7/2019

This article appeared first on BJPENN.COM

Topics:

Bellator UFC